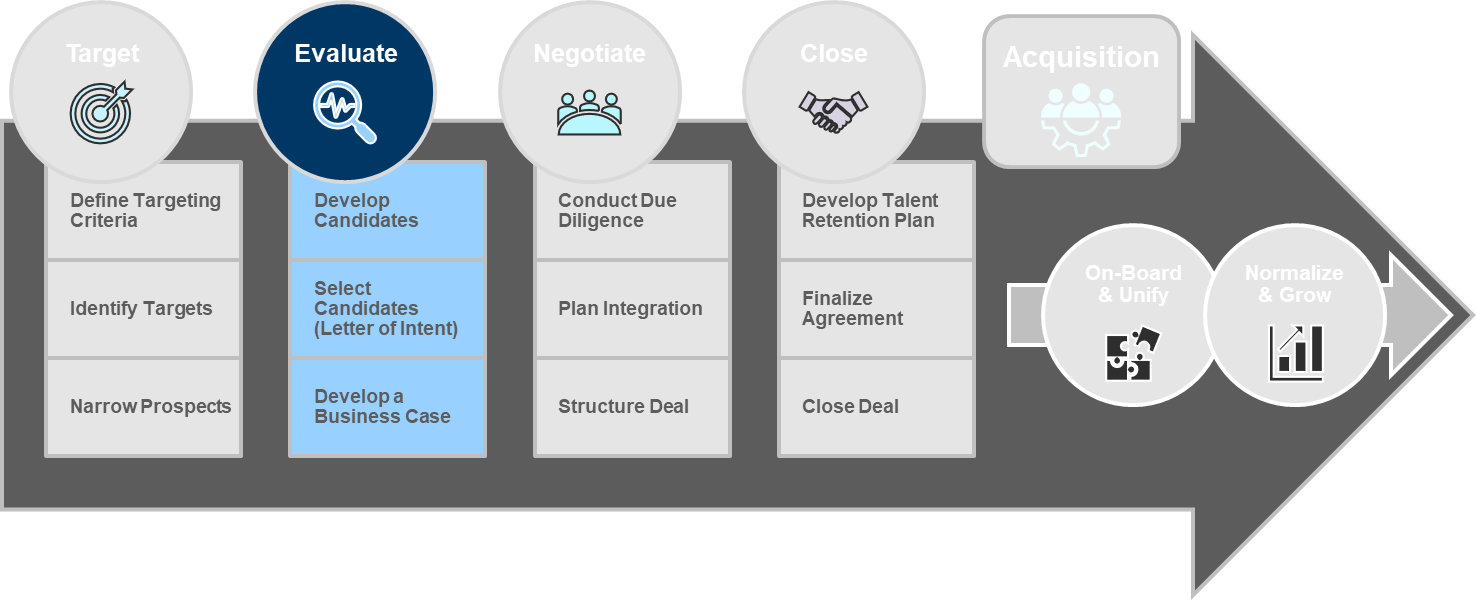

In prior blogs in this series, we outlined a deliberate process to help Professional Services (PS) firms make the best business acquisitions based on their strategic, financial, and growth goals. We detailed the Targeting stage, where businesses create a broad list of acquisition targets and narrow it to a list of possible acquisition targets based on established criteria.

The Target Phase is completed when a list of prospects that fit the target criteria is narrowed to a “short list.” This marks the beginning of the second stage, Evaluate, where the short list is contacted to begin mutual evaluation.

Once the list is narrowed, the first step is to Develop the Candidates to determine interest and viability as an acquisition.

In developing the candidates, it’s important to identify and connect with principals at the target: C-suite, Partners, Board Members depending on the structure of the organizations. These conversations should dig into additional information on the target to validate some of the assumptions you had when you added them to the list. It also provides an opportunity to gauge the principals’ intent for the target – are they interested in selling? Would they make a strong partner?

Deeper evaluation for this set of targets also includes:

- Strategic Alignment – validating or updating prior understanding of the role that the target can play in the portfolio, growth strategy, etc.

- Market Fit – gaining a clearer understanding of the markets, segments, and clients that the target is successful in or could be successful in

- Financial Importance – determining the financial impact the acquisition will make on the business

- Talent – Capacity & Capability – delving into the depth and breadth of the principals and full team and assessing risks for flight, fit, etc.

- Fit for Purpose – identifying barriers to integration of the acquisition into your operating model and culture to ensure their strategic fit can be realized

- Motivation to Sell – learning the impetus and intensity of the target’s desire to sell to help you evaluate likelihood of a deal and potential deal structures

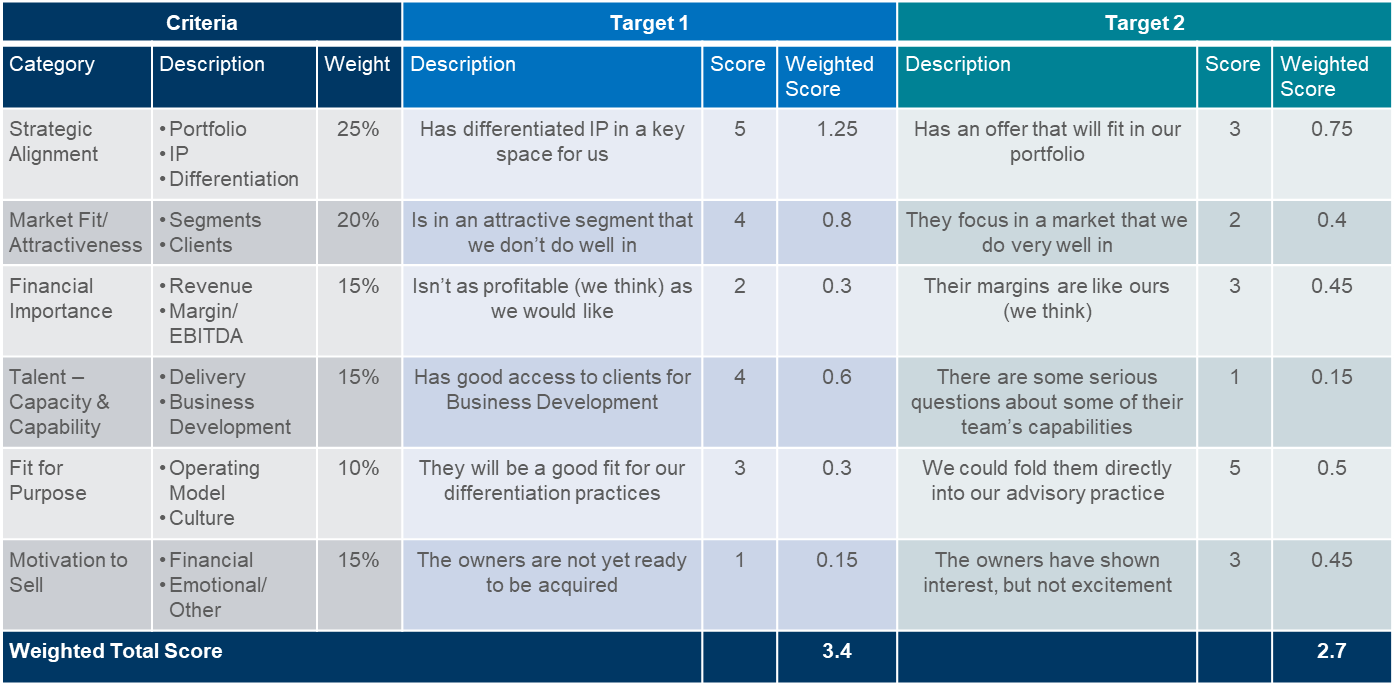

After evaluating the candidates, you can use a Weighted Criteria Matrix to complete the Evaluation of the Narrow List of Targets. In doing so, you will:

- Assign a value for each of the target criteria

- Evaluate each potential target and prioritize

The following detailed criteria are used to finalize selection of candidates to enter a Letter of Intent:

After each candidate has been through the evaluation, the list of prospects is narrowed to final candidates. Letters of Intent are developed and signed for each candidate.

A Business Case is performed on the candidate(s) once the letter of intent is signed. The company to be acquired will provide detailed financial and operational information:

- A business case is developed once the financials are verified.

- Synergies are evaluated and inserted into the business case to identify value creation in the business case.

- Final valuation is prepared, break-even point is identified, and potential price range is determined. A sensitivity analysis of the assumptions (synergies) allows for some flexibility in price and structure as due diligence is performed.

After evaluating the final list of candidates, you can move forward with executing a letter of intent and enter the next phase, Negotiation.

Written by: Doug Long and Sarah Cushman

About the Authors:

Doug Long is a Partner with McMann & Ransford and has more than 26 years of experience in consulting across various industries, topics, and client challenges. Prior firms include Deloitte and GE. He currently leads our Healthcare Practice.

Sarah Cushman is a Senior Consultant with McMann & Ransford and has experience working with Fortune 500 companies to solve complex challenges, drive differentiation, and create long-term value.