As discussed in our previous blog, most companies agree that a Portfolio plays a strategic role, yet we consistently see organizations use portfolio as a catch-all at the end result of market sizing and R&D. Oftentimes, organizations fall prey to a “Typical State” portfolio that acts as a broad offer/sales catalogue over time.

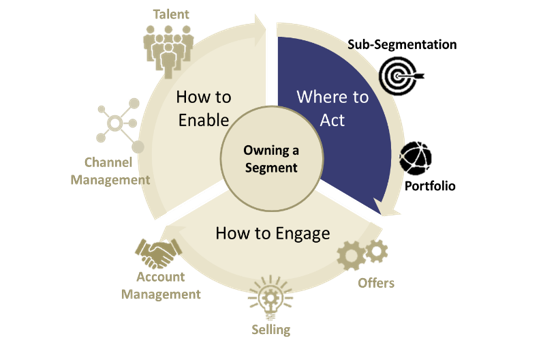

There are 3 significant decisions to make when building a market-back portfolio that addresses your customers’ needs and drives significant value for both them and your organization. This blog focuses on decision #1: What market segments and sub-segments are you truly targeting?

Key considerations when making this decision:

- Specificity matters – it is best for your customers, sales teams, delivery

teams, etc. This doesn’t mean you won’t sell to other portions of the market, but there needs to be a target customer profile on which you base a new solution (or set of solutions). The narrower that profile is, while still being large enough to be financially meaningful to the business, the better, because your solution will be more tailored to their specific needs.

teams, etc. This doesn’t mean you won’t sell to other portions of the market, but there needs to be a target customer profile on which you base a new solution (or set of solutions). The narrower that profile is, while still being large enough to be financially meaningful to the business, the better, because your solution will be more tailored to their specific needs. - Give yourselves freedom to look at the financial opportunity through a lens of “what’s possible”. In other words, don’t limit the financial assessment to only your current solution set – think about all the potential areas that you could have “permission” to play.

- Customer satisfaction surveys are helpful but do not provide the type of data needed. Instead, conduct market research interviews with key customers. They are a good way to validate their needs and appetite to buy and increase customer satisfaction by having meaningful business outcome discussions when interviewing.

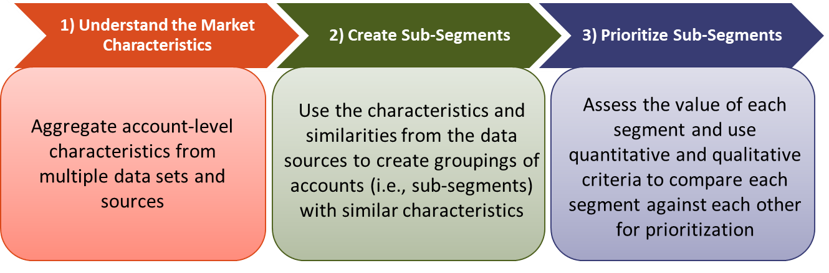

Segmentation Process

In most industry vertical markets (e.g. financial services, consumer packaged goods, etc.), there are too many buyers or customers to view them all individually. Organizing a segment into sub-groups with similar characteristics (both demographic and “buying” characteristics) helps you understand how/where to best allocate scarce resources. We do this by using process for organizing a market segment into sub-segments through a three-step approach.

Note that this is a continuous process that should be revisited and updated as you better understand the market and as the marketplace changes over time.

One of the key outcomes of sub-segmenting the market is visibility to which accounts and offers should receive the majority of your time, energy, and resources – i.e., identifying the sub-segments that are most important based on propensity to buy, ROI on time spent on an account-by-account basis, and identifying the offerings that would impact the greatest number of important sub-segments.

Remember, there are 3 significant decisions to make when building a market-back portfolio that addresses your customer’s needs and drives significant value for both them and your organization. We will dive into the other two decisions and their implications in later blogs in the series:

- What challenges do they have that need solving and/or what opportunities do they have that we can help them create?

- What solutions can we provide to address those challenges and opportunities?

Written by: Mark Slotnik and Sarah Cushman

About the Authors:

Mark Slotnik has spent nearly 20+ years advising clients in the areas of designing and taking to market high-value business solutions, solution portfolio management, talent development, resource management, business process re-engineering and commercial software.