This is not a typical post for the McMann & Ransford blog so for those of you in search of one of those, excuse the self-help nature of this post and come find us next week. In light of the surge of people transitioning to working from home for an extended period of time the first time, we thought that one of the few ways we could help was to pass along some of the lessons we have learned about working from home and managing teams remotely. The following list of recommendations hopefully can assist some of you as you adjust to a completely (or partially) remote-based work environment.

1) Separate Work Time from Non-Work Time

This one should be familiar to anyone that has ever allowed their work to come home with them – you can’t let the lines blur too far between your personal life and your work life or soon you won’t have a personal life. The work never stops and has the potential to consume you if you feel like you need to immediately respond to everything and clear everything from your to-do list. This is incredibly difficult when you are working from home and your hours are more flexible, and you are trying to “prove” your worth to people that can’t see that you are getting in early and leaving late every day.

2) Separate your Work Space from your Non-Work Space

The easiest way I have found to separate your work time and non-work time is to physically separate the spaces where you enjoy personal time vs. the space that you work. This doesn’t have to be a separate floor, separate room, or anything that significant if your space doesn’t allow for it – trust me, when I first began working remotely, I shared an apartment and the only place I had to myself was my 10×10 room; I was still able to manage this separation. It is as simple as establishing a place to do work. As soon as you start working in bed, on your couch, etc., the line between work & personal space begins to blur. That risk goes both ways – you might get distracted with other things and be less productive if you do not have a “work space”, but the opposite is also true, you may find yourself working into the night on things that don’t matter and risk getting burnt out unnecessarily.

3) Get Out

Despite everything I said in the last recommendation, you need a change of scenery every once in a while, especially if you are doing any type of creative work. If you can leave the house, go to a coffee shop or a park. If you can’t leave the house, find a spot outside to work or move your desk close to a window and open it up. Even taking a 15-minute walk around the block can help clear your mind and get you out of the house. In fact, I bet most people do this in an office environment without thinking much about it. Working from home, especially when you aren’t doing any other traveling outside the house, means that you are spending days in the same environment which can be mentally draining. In order to stay focused and productive, I’ve found its critical to inject a different environment into your work-life occasionally.

4) Schedule EVERYTHING

Depending on your role, your calendar may already be full with phone calls and meetings, which is a forcing-function to remain productive throughout the day. However, for most people their calendar is not already scheduled for them for an entire week, and you need to make sure you have time set aside for your work task. If you are already in a habit of scheduling your blocks of work time, particularly your individual “heads-down” work time, feel free to skip to the next suggestion. Scheduling everything (as far in advance as possible) and sticking to that schedule seems to help with this. In addition to your phone calls and meetings, set meetings with yourself to get done everything else you need to do. For example: if you get overloaded by emails that you spend all night replying to, schedule 30 minutes twice a day to go through and catch up on emails; if you need to do an expense report, schedule it once a month; if you need to create a presentation for a meeting later in the week, put it on the calendar for an hour a day until it is done. This scheduling doesn’t need to be limited to work activities, you have a more flexible schedule now, so take advantage of that and schedule lunch (because if you don’t, people will fill up your calendar and you will inevitably miss it), schedule time to work out, pick up your kids, etc.

If it is on the calendar, treat that time as sacred and don’t move it unless you absolutely have to do so, and do what you planned to do – don’t get drawn into other activities. Additionally, the act of reserving time on the calendar as “busy” can show coworkers that you’re unavailable, so you won’t get bogged down with outside distractions if they can wait. Final suggestion here – don’t schedule anything for yourself for more than 90 minutes at a time – it is difficult to remain focused for that long, and if you start blocking out entire days to work on something, you will inevitably not spend that entire time exclusively on the activity you had planned.

5) Establish a Start-Up & Wind-down Routine

In addition to scheduling your actual workday – think about how you get ready for the day and wind it down. What time are you going to start working for the day? Are you going to have breakfast/a cup of coffee first? What about shower and get ready for the day? You will likely get a lot of advice on when to start and what to do to be productive – some people swear by getting ready for the day as if you are going into the office, but I have found that you need to determine what works best for you. There is less advice out there on this topic, but I feel it is just as important, and that is determining how you will wind down your day. Are you going to stop at a certain time? Are you going to do a specific work activity to close out your day (e.g., clean out your inbox)? Or are you going to do something else to signal the workday has come to a close (e.g., creating a to-do list to begin the next day with)? Whatever you choose, something needs to replace the drive home that otherwise signaled that the day was over. (this ritual helps with tip #1, establishing work and non-work time).

6) Adjust that Routine & Schedule as Soon as You Know Better

Stick to your schedule and routine for at least the first week, but once you have spent a few weeks at home, reflect on your assumptions and see if they need adjustment. For example, over the years, I have found that my low energy period of the day is between 2-4PM. I know that unless I am up against a deadline, I am not going to be very productive at this time, so what do I do about it:

- Schedule my creative time in the morning

- Set aside my late afternoon time for phone calls (which force me to be engaged and productive)

- If I don’t have enough/any phone calls for that afternoon, I might plan a late lunch or a workout or something non-work related during that time, and make up for the lost time earlier in the morning or later in the evening when I actually have more energy (for me it is typically 8-10PM)

Unfortunately, the world doesn’t always operate on, or align with, your schedule – so this doesn’t work every day, but if you try to organize your day to work best for you, you’ll be surprised how often it works out.

7) Keep it Clean

You don’t have to be a “clean freak” to benefit from keeping your area neat and tidy. If your work area is clean, there are surprisingly less distractions. Keep only the essentials on your desk and I suspect you will see an improved ability to focus.

For some people, this extends beyond your workspace. Clutter across the house can be distracting and make you itch to clean up when you should be completely scheduled tasks. With kids who are at home with you, it may be impossible to limit all clutter – but allocating some time in the morning or evening to de-clutter around the rest of your house can keep you from doing it mid-day instead of focusing on work.

8) Don’t Forget About Your Team

In the office, team building comes much more naturally than it does remotely. Between the proverbial water cooler and the ability to poke your head into someone’s office, there are countless opportunities to connect and build relationships with your team. When you are remote, doing this is still possible, but requires making a bit more of an effort. Find the right cadence of team calls and 1-on-1 calls with your team to maintain regular touchpoints (even if you didn’t have regular meetings when you were working in the office). Remember that not all calls have to be (or should be) work-related. For example, I will often connect with coworkers to hear about their weekends or how their weeks are going. It goes a long way to show you care about your colleagues and maintain the camaraderie that you have in a face-to-face environment.

Set expectations for your team about when and how to get in contact with you – one thing we often see is that team members are reluctant to reach out and “bother” their manager for things they would typically be comfortable popping in their manager’s office to ask – and as a result they feel they aren’t getting the support they need. As simple as it sounds, letting your team know they can reach out to you by phone with any questions they have, texting them or following up by email when you are unable to answer, and returning their call or answering their question in a timely manner, will provide them with the support they need. Then keep an eye on the team for unusual behaviors and reach out to them if you get any sense that someone needs additional support or attention (e.g., someone used to be very vocal in the office environment, but is unusually quiet on team meetings; or, a historically productive team member is slow to respond).

9) “Managing Up”

The opposite end of the prior recommendation – give your leader the benefit of the doubt when they aren’t able to get back to you immediately, use their time wisely, but don’t hesitate to reach out when you need something critical from them or have important information to share. Also, keep in mind that just because you aren’t watched doesn’t mean you are invisible – assume that your leaders trust you and know you are working hard unless you do something to break that trust. Productivity will be all over the board as people adjust to working from home, however in many cases it will normalize once everyone finds their rhythm and routine.

10) Don’t neglect your mental health

People adjust to new environments differently – some people are flexible by nature and change doesn’t phase them, while others go through a period of adjustment that can impact their mental state. This adjustment period can be exacerbated by feeling “stuck” in your home. During this time, it’s important to check in with yourself to make sure you are feeling just as comfortable and productive as you would be in the office or traveling. Reach out remotely with a mental health professional if you think you need a little additional emotional support throughout your transition.

Hopefully one or more of these recommendations are helpful for those of you that are adjusting to a remote work environment. The important thing to keep in mind is to find what works best for you.

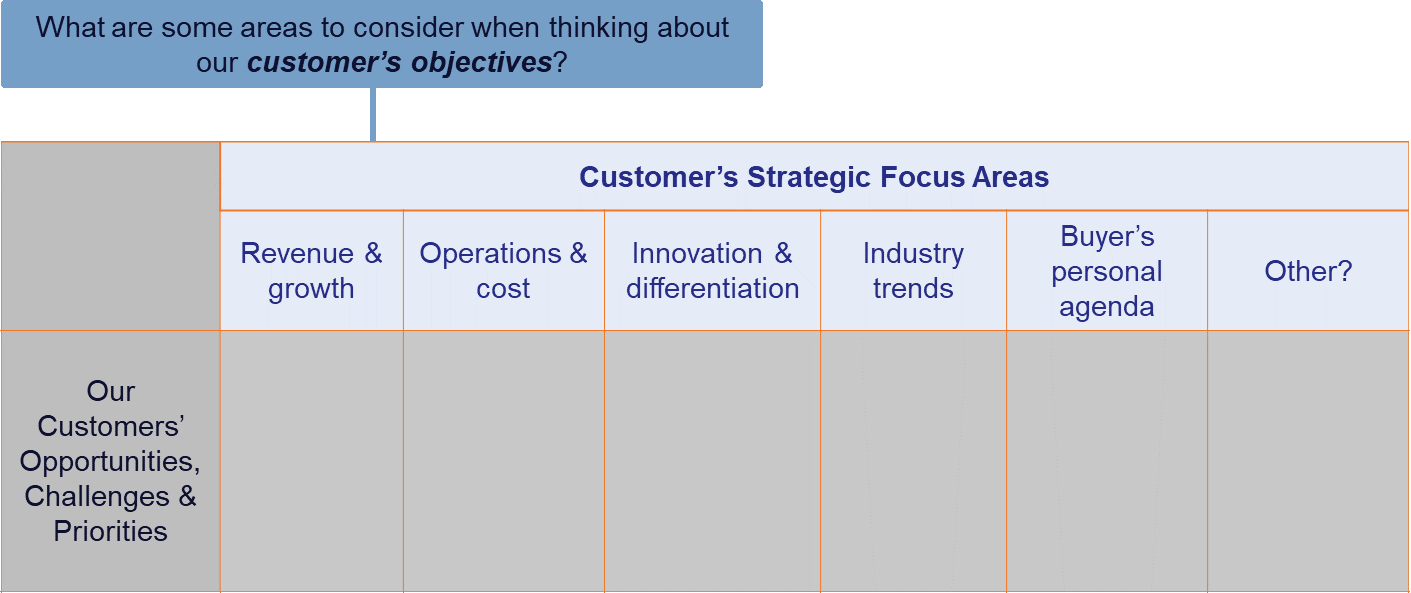

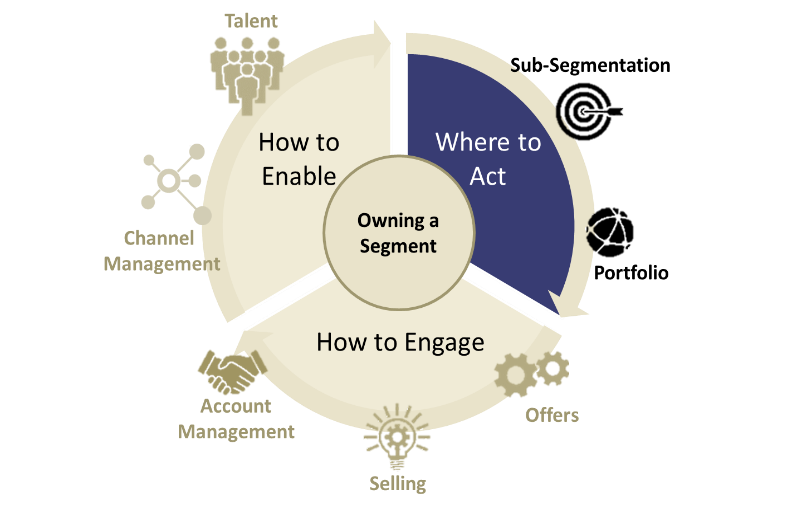

sub-segment and their objective. It is important to be honest and admit reality: force-fitting existing solutions to problems can hurt your credibility and future opportunities.

sub-segment and their objective. It is important to be honest and admit reality: force-fitting existing solutions to problems can hurt your credibility and future opportunities. and how material are they?

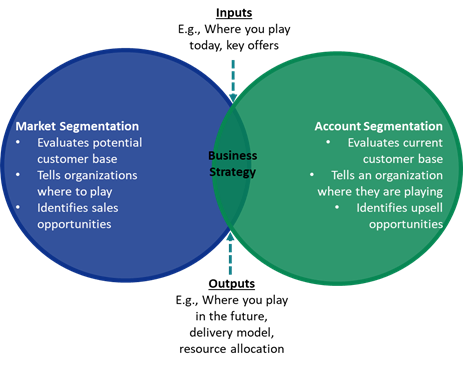

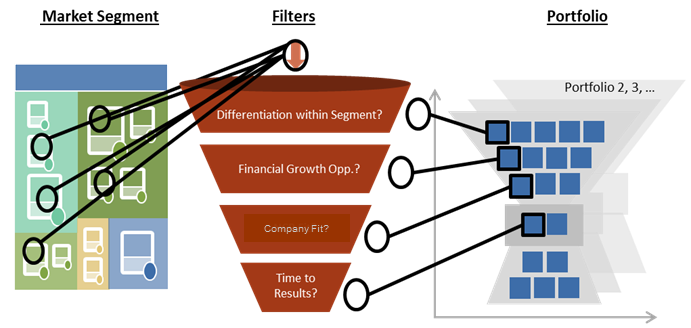

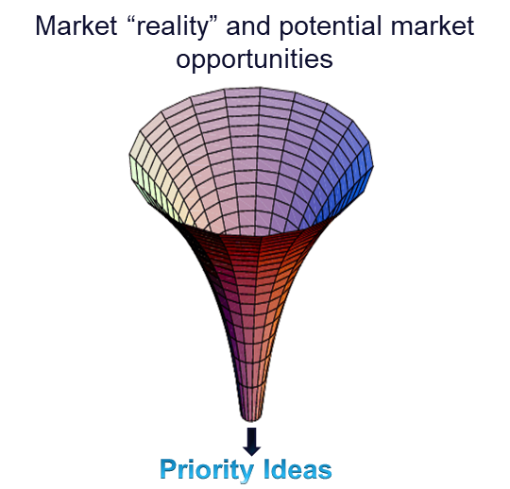

and how material are they? interviews – in addition to electronic surveys – and gather insights from your market-facing resources. Also leverage but don’t rely on market publications/ reports; if the information is in those reports, it is often either too generic or you are too late and therefore run the risk of being undifferentiated in the market.

interviews – in addition to electronic surveys – and gather insights from your market-facing resources. Also leverage but don’t rely on market publications/ reports; if the information is in those reports, it is often either too generic or you are too late and therefore run the risk of being undifferentiated in the market.