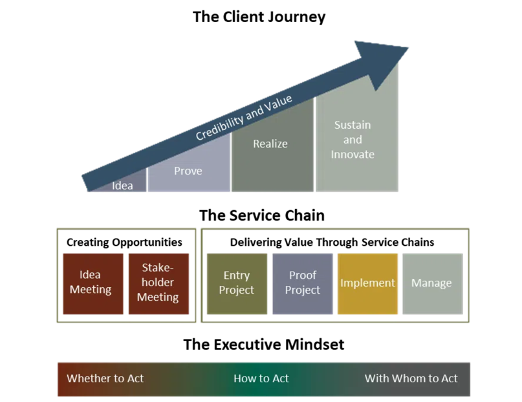

Throughout this blog series, we have made the case that creating and implementing strategies is a full-time job best completed by an owner with the authority to hold others accountable. In many cases, this means creating a growth focused executive role (Chief Commercial Officer, Chief Growth Officer, etc.). In this blog, we will discuss the spectrum of ways that an organization can provide support for this new executive position.

The Purpose of the Growth Strategy Team

As growth executives create, analyze, and adjust the strategies that they create, they also work to align every piece of their organization to that strategy. In very few cases are these activities one-time events or with small groups of people. Instead, these activities are constant day-to-day initiatives that occur simultaneously with team members throughout the company. Therefore, in many cases these responsibilities require the support of a team rather than the focus of a lone individual. The key question is how does one create that team?

How to Build a Team for Executing a Growth Strategy

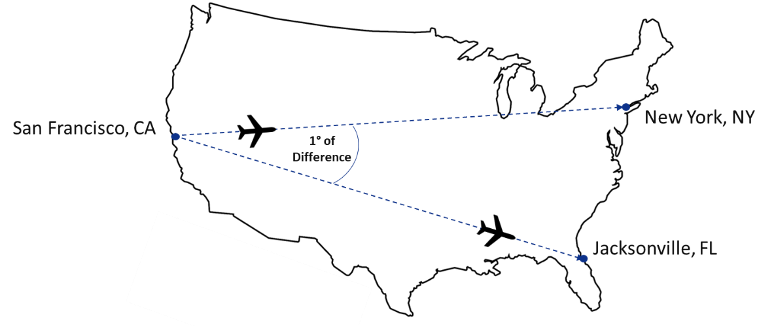

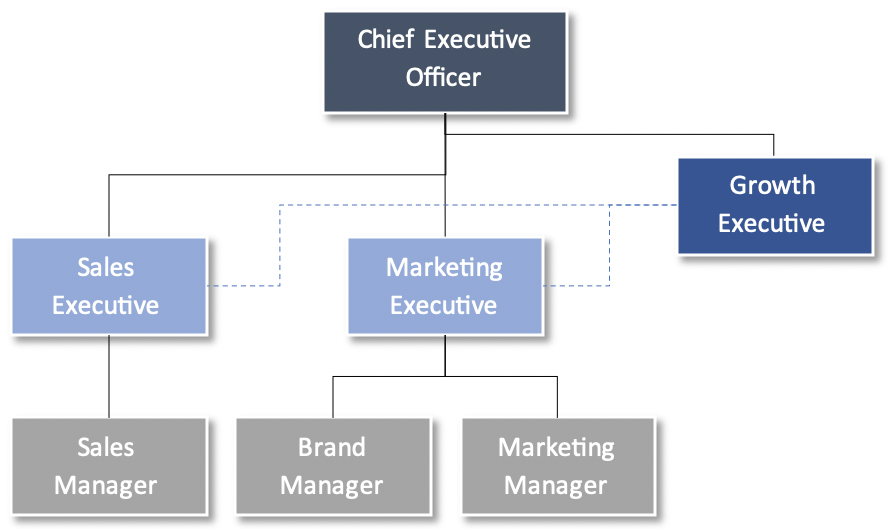

A spectrum of team types exist with relation to differentiated growth strategies. On one end, organizations create a full-time team that allocates 100% of their focus towards supporting the Growth Executive and driving the team forward. On the other end of the spectrum, organizations instead instill existing leadership and other team members with strategic responsibilities but do not have those team members report directly to the growth executive.

Fully Focused Team – Benefits and Challenges

A fully designated team that directly reports to the growth executive both benefits and suffers from that specific org structure. A team such as this takes ownership of the strategy themselves while motivating and encouraging others to become involved.

Benefits include:

- Clear ownership and accountability of strategic initiatives

- Does not add additional responsibilities to leadership team

- Full focus of a number of team members on strategic priorities

Challenges include:

- Functions can perceive organizational strategy as the exclusive responsibility of the full-time team

- Full-time team must heavily rely on insights from customer-facing teams

- Must add and demonstrate value for the broader organizational teams

Partially Focused Team – Benefits and Challenges

A team that assumes parts of the organizational strategy and indirectly reports to the growth executive also has its own unique benefits and challenges. While these leaders are likely experts at communicating to and motivating their team, managing their existing team is a full-time job in and of itself without any additional responsibilities.

Benefits include:

- Constant leadership focus on strategic initiatives

- Customer-facing teams are pushed to have a strategic focus

- Existing credibility within the organization to motivate teams to action

Challenges include:

- No clear ownership over strategic initiatives

- Adds to the responsibilities of already busy leaders

- Splits focus of strategic priorities among many

Mixing and Matching

As organizations find what works best for them, they may come up with their own unique combination of the two types of teams (ex. a couple designated corporate strategy team members reporting directly to the growth executive and a couple of existing leadership team members having a “dotted line” report to the growth executive), hence the spectrum. Each location on the spectrum has benefits and challenges associated with it, there is no one correct answer.

Capabilities of a Strong Growth Executive

Regardless of the type of team that is created to support the growth executive, a certain skill set will be helpful as the growth executive looks to drive a differentiated growth strategy forward. First and foremost is leadership. Growth strategies embedded with differentiation are difficult to implement. It will undoubtedly be challenging as the organization changes its mindset, looks to assume new responsibilities, and achieve new heights. The organization will constantly look towards the growth executive for support, encouragement, and direction. Therefore, the growth executive’s leadership capabilities will play a large role in the success of the strategies they own.

Another key tenet of a growth executive is open-mindedness. As we have alluded to, no matter how much effort goes into the creation of a strategy, the reality is it will likely not be 100% correct. Even if it is perfectly accurate, the world changes and new opportunities may arise that require a new strategy or at minimum an adjustment. Leaders without an open-minded approach to their strategy may find themselves battling against an organization looking to assume a new direction, in essence holding an organization back rather than driving it forward.

Conclusion

In conclusion, establishing an adept team for executing growth strategies is pivotal in navigating today’s competitive business environment. The right team structure coupled with the leadership acumen of a growth executive can steer an organization towards remarkable success.

Written by: Mark Slotnik and Jack Draeb

Mark Slotnik has spent nearly 20+ years advising clients in the areas of designing and taking to market high-value business solutions, solution portfolio management, talent development, resource management, business process re-engineering and commercial software.

Jack Draeb is a Senior Consultant with McMann & Ransford who has experience working with Fortune 1000 companies to identify issues, define solutions, guide change management, and deliver lasting results.